MyFedLoan Login: Student loans can be a significant financial responsibility for many individuals. With the ever-increasing costs of education, it’s essential to have a reliable platform to manage your loans effectively.

MyFedLoan is one such platform that offers a range of services to help borrowers handle their federal student loans efficiently.

In this article, we will explore MyFedLoan in detail, guiding you through its features, benefits, and how to make the most of this valuable resource.

What is MyFedLoan?

MyFedLoan is a student loan servicing company that partners with the U.S. Department of Education. It manages federal student loans on behalf of borrowers, providing services such as processing payments, offering repayment options, and assisting with loan forgiveness programs.

Whether you have Direct Loans, Federal Family Education Loans (FFEL), or Perkins Loans, MyFedLoan can help you navigate the complexities of loan management.

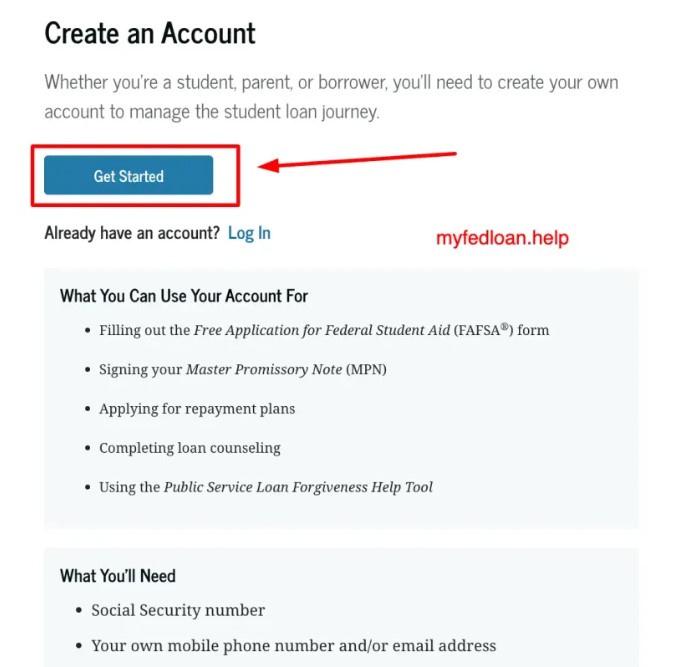

How to Create a MyFedLoan Account?

To get started with MyFedLoan Login, you need to create an account on their website. Follow these steps to set up your MyFedLoan account:

- Visit the MyFedLoan website at www.myfedloan.org.

- Click on the “Create an Account” or “Sign Up” button.

- Provide the required information, including your personal details and loan account information.

- Create a username and password for your account.

- Agree to the terms and conditions.

- Complete the verification process, if necessary.

- Once verified, you can log in to your MyFedLoan account.

How to Log in to the MyFedLoan Portal?

To log in to the MyFedLoan Portal, follow these steps:

- Go to the Myfedloan Servicing website – www.myfedloan.org.

- Click on the “Log In” button located on the homepage.

- Enter your username and password in the provided fields.

- Click on the “Log In” or “Sign In” button to access your account.

Make sure to use the correct credentials associated with your MyFedLoan account to log in successfully.

Upon logging in to your MyFedLoan account, you will be greeted with a user-friendly dashboard. Here are some key features and sections you can explore:

- Loan Summary: View an overview of your loan details, including outstanding balance, interest rates, and repayment status.

- Payment History: Track your past payments and review any outstanding amounts.

- Repayment Plans: Explore various repayment options available to borrowers and choose a plan that suits your financial situation.

- Loan Forgiveness: Learn about eligibility criteria and apply for loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF).

- Communication Center: Stay updated with important messages, notifications, and alerts from MyFedLoan.

- Documents and Forms: Access and submit loan-related documents and forms securely.

Benefits of MyFedLoan

By choosing MyFedLoan as your loan servicer, you gain access to several benefits that make the repayment process more manageable. These benefits include:

- Online Account Management: MyFedLoan offers a user-friendly online platform that allows borrowers to track their loan balance, make payments, update contact information, and explore repayment options.

- Dedicated Customer Service: MyFedLoan’s customer service representatives are knowledgeable and readily available to address borrower inquiries and concerns. They can provide guidance on repayment plans, loan forgiveness programs, and other loan-related matters.

- Loan Forgiveness and Repayment Assistance Programs: MyFedLoan administers various federal loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness. They can assist borrowers in determining eligibility and navigating the application process.

- Flexible Repayment Options: MyFedLoan offers a range of repayment plans tailored to individual financial situations. These plans include Income-Driven Repayment (IDR) options, which calculate monthly payments based on income and family size.

Repayment Options Available on MyFedLoan

MyFedLoan offers several repayment plans to accommodate borrowers’ diverse financial circumstances. Here are some popular options:

- Standard Repayment Plan: This plan allows you to make fixed monthly payments over a ten-year period, ensuring your loan is paid off within the specified time.

- Income-Driven Repayment Plans: These plans calculate your monthly payments based on your income, making them more affordable for borrowers facing financial difficulties. Examples include Income-Based Repayment (IBR) and Pay As You Earn (PAYE).

- Graduated Repayment Plan: With this plan, your payments start low and increase gradually every two years. It suits borrowers who expect their income to rise steadily over time.

How to Make Payments to FedLoan Servicing?

FedLoan Servicing is a loan servicer that works with MyFedLoan to manage federal student loans. To make payments directly to FedLoan Servicing, you can:

- Visit the FedLoan Servicing website.

- Log in to your account using your username and password.

- Navigate to the payment section.

- Choose your preferred payment method and provide the necessary details.

- Enter the payment amount and select the loans you wish to pay.

- Follow the instructions to complete the payment process.

Applying for Loan Forgiveness

Loan forgiveness programs offer relief for borrowers who meet specific criteria. MyFedLoan provides guidance and support throughout the loan forgiveness application process.

One notable program is the Public Service Loan Forgiveness (PSLF), which forgives the remaining loan balance for borrowers working full-time in public service or non-profit organizations after making 120 qualifying payments.

To apply for loan forgiveness:

- Ensure you meet the eligibility requirements for the chosen program.

- Complete the necessary application forms.

- Submit the application and required documentation through MyFedLoan.

- Keep track of your progress and ensure timely submission of annual certification forms.

Managing Your Student Loan Payments

To successfully manage your student loan payments:

- Set up automatic payments through MyFedLoan to avoid missing deadlines.

- Create a budget to allocate funds for loan payments and other essential expenses.

- Explore options to pay more than the minimum monthly payment to reduce interest and shorten the repayment period.

- Consider refinancing or consolidation if it aligns with your financial goals.

- Regularly review your loan information on MyFedLoan to stay informed about changes and updates.

Avoiding Default

Defaulting on your student loans can have severe consequences, including damage to your credit score and legal actions. Here’s how to avoid default:

- Stay in touch with MyFedLoan and update your contact information promptly.

- Explore options for deferment or forbearance if you encounter financial hardships.

- Communicate with your loan servicer to discuss alternative repayment plans if needed.

- Seek financial counseling and advice if you’re struggling to make payments.

- Take advantage of loan rehabilitation programs to restore your loan to good standing.

Dealing with Difficulties in Loan Repayment

If you’re facing difficulties in loan repayment, remember that you’re not alone. MyFedLoan provides assistance and resources to help borrowers navigate challenging situations. Here are some steps to consider:

- Contact MyFedLoan’s customer service to discuss your situation and explore possible solutions.

- Seek guidance from a student loan counselor or financial advisor.

- Review income-driven repayment plans and request an adjustment if your financial circumstances change.

- Explore loan consolidation options to simplify repayment and potentially lower interest rates.

- Stay proactive and informed about available resources and programs for struggling borrowers.

How to contact FedLoan Servicing

MyFedLoan Phone Number

- Toll-free Number: (800) 699-2908 from Monday-Friday ( 8 a.m. – 9 p.m.)

- For International clients: (717) 720-1985 from Monday – Friday (8 a.m. – 9 p.m.)

- Fax: (717) 720-1628

Mailing Address

Payments:

Department of Education

FedLoan Servicing

P.O. Box 790234

St. Louis, MO 63179-0234

Completed Direct Debit application forms:

FedLoan Servicing

P.O. Box 3661

Harrisburg, PA 17105-3661

Letters and correspondence:

FedLoan Servicing

P.O. Box 69184

Harrisburg, PA 17106-9184

Credit disputes:

FedLoan Servicing Credit

P.O. Box 60610

Harrisburg, PA 17106-0610

Consolidation related letters and correspondence:

FedLoan Consolidation Department

P.O. Box 69186

Harrisburg, PA 17106-9186

The Office of Consumer Advocacy:

Pennsylvania Higher Education Assistance Agency

The Office of Consumer Advocacy

1200 North 7th Street

Harrisburg, PA 17102

Frequently Asked Questions (FAQs)

Who is replacing FedLoan?

FedLoan Servicing is currently being replaced by other student loan servicers. As of now, the U.S. Department of Education has awarded new contracts to several loan servicing companies, including Edfinancial, F.H. Cann & Associates, MAXIMUS Federal Services, MOHELA, and Texas Guaranteed Student Loan Corporation (Trellis Company).

These servicers will take over the management of federal student loans previously serviced by FedLoan.

What happened with FedLoan?

FedLoan Servicing, also known as the Pennsylvania Higher Education Assistance Agency (PHEAA), was a major student loan servicer that managed federal student loans on behalf of the U.S. Department of Education.

However, the U.S. Department of Education decided not to renew FedLoan’s contract, and as a result, other loan servicers have been selected to take over the servicing of federal student loans.

Are student loans forgiven after 20 years?

Yes, there are certain loan forgiveness programs that may forgive remaining student loan balances after 20 years of qualifying payments. One such program is the Income-Driven Repayment (IDR) Plan forgiveness.

Under this plan, borrowers who make payments based on their income for a specified period (usually 20 or 25 years, depending on the plan) may be eligible for loan forgiveness on the remaining balance.

However, it’s important to note that not all loans or repayment plans qualify for forgiveness, and specific eligibility criteria must be met.

It’s recommended to consult with your loan servicer or a financial advisor for more information on loan forgiveness options.

Can I apply for loan forgiveness if I have private student loans?

No, loan forgiveness programs offered through MyFedLoan are applicable only to federal student loans.

Can I change my repayment plan after I’ve already started making payments?

Yes, you can switch to a different repayment plan by contacting MyFedLoan and following the necessary procedures.

Can I make extra payments towards my student loans?

Yes, making additional payments can help you pay off your loans faster and reduce the overall interest you owe.

Can I access MyFedLoan from a mobile device?

Yes, MyFedLoan has a mobile-friendly website and a dedicated app available for both iOS and Android devices.

Is there a fee to create a MyFedLoan account?

No, creating a MyFedLoan account is free of charge.

Conclusion

MyFedLoan serves as a valuable resource for borrowers managing their federal student loans. By leveraging the platform’s features and tools, borrowers can effectively track their loan progress, explore repayment options, and access loan forgiveness programs.

Remember to stay proactive and informed throughout your loan repayment journey to achieve financial freedom.